Data Analytics

we turn data into decision

Our Products

Increase the potential of your business and investments through our

DATA ANALYTICS products and MAP solutions.

R-Insight enables you to view, analyze and download real estate data on the dynamic dashboards with advanced filtering options. Area level aggregated data reports as well as individual property reports offers you latest real estate transactions, asking prices, price trends, occupancy levels, service charges and real estate supply metrics on the advanced yet user friendly dashboards.

We can also customize the dashboards with your own data sets for your advanced analytic needs.

Over 70% searches on the search engines are related to location.

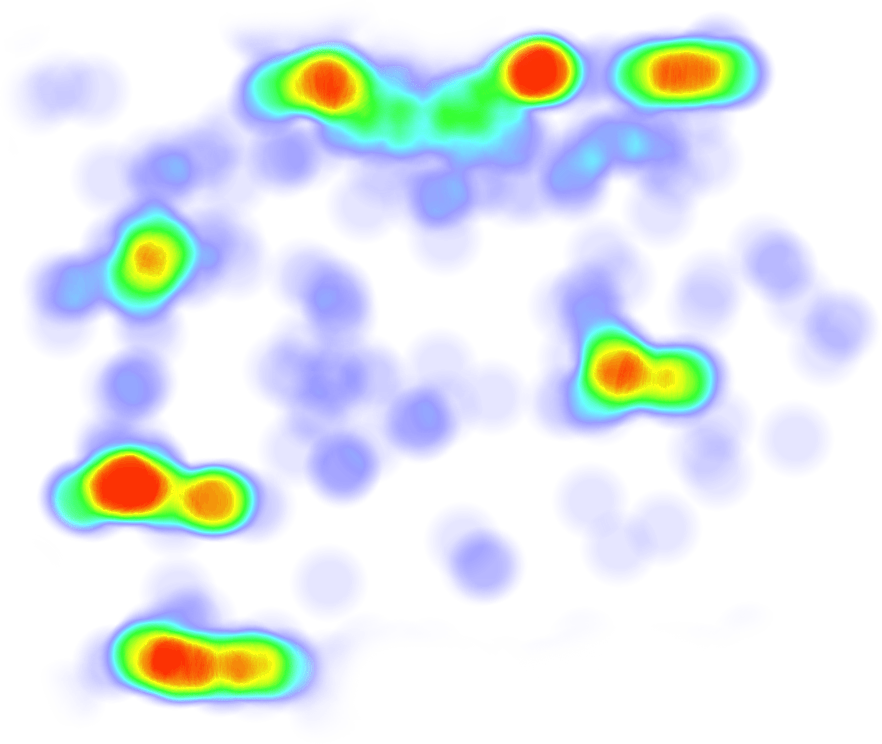

R-Map provides data visualization on a map tool with dynamic heat and choropleth maps. Real estate data series enhanced with Point of interests, urban planning tools and micro market analysis tools.

R-Rebis provides real estate data in a granular format that enables you to view and download the data sets. The platform with the summary of the data in each section helps you make better decisions.

R-Retail enables you to combine any located based data on a smart map tool layers to find out the potential of specific location or point.

Our Services

DATA API SERVICES

CUSTOM RESEARCH REPORTS

DASHBOARD/DATA VISUALIZATION SOLUTIONS

REIDIN Data Processing

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

What our customers are saying about us

REIDIN’s intuitive Insight portal provides a superb platform for us to explore the latest data trends in Dubai’s residential market. Additional drilldown features help to unpick submarket level nuances that are critical in understanding Dubai’s complex residential market landscape.

Faisal Durrani

REIDIN provides comprehensive data and analysis in a user-friendly format, supporting us in delivering timely and reliable recommendations to our clients. The platform continues to evolve, offering new features and analysis backed by credible research. The tools included within REIDIN Insight are especially useful, providing ready access to a range of trends, indices and area insights across residential and commercial property sectors.

Chris Hobden

Chesterton International LLC

Informative and essential for Stones International. Excellent Account Management/Manager Ahd support. The team can not effectively operate with out REIDIN.

Christopher Simon

Reidin has been a tremendous asset to our business. Apart from providing us information on transactions, supply, trends and even project information, Reidin helps us prepare Market Appraisal Reports & Presentations.

Akhil CHIMNANI

I think REIDIN is one the most important transactional data providers catering to the Dubai real estate market, and it has certainly come a long way since I first started using the service back in 2007.

Haider TUAIMA

REIDIN’s intuitive platform allows access to their comprehensive residential and commercial real estate data, allowing CBRE to decipher the trends within the market from a city level overview to submarket trends and even individual projects.

Taimur KHAN

REIDIN's intuitive portal provides accurate and reliable data of residential and commercial real estate, allowing us to analyze the range of trends with city level to submarket and individual projects. These multidimensional trends support us in our valuation services in a proper transparent way.

Abhinav Sharma

Great companies trust REIDIN

Working with the Leading Companies of their sectors